Buy 1099-Nec Tax Forms Online - Fiscal Year: 2023

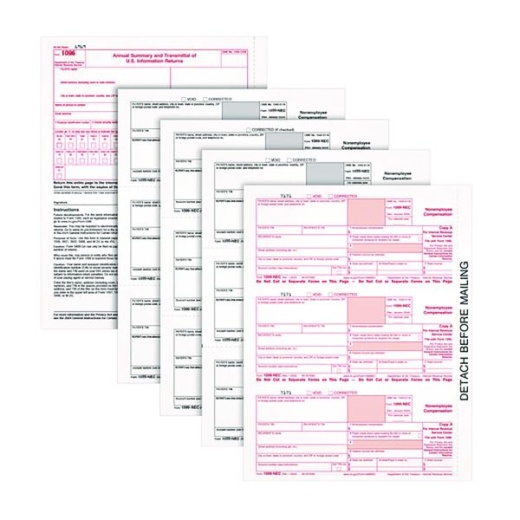

Are you looking for a reliable and compliant way to report nonemployee compensation to the IRS and your recipients? Look no further than the TOPS 1099-NEC Tax Forms, designed for the fiscal year 2023. This pack includes 50, 5-part 1099-NEC sets and three 1096 summary forms, making it easy to report compensation to up to 50 recipients.

Compliant with IRS Specifications

The TOPS 1099-NEC Tax Forms are designed to meet IRS specifications, ensuring that you can produce compliant records with ease. The forms are printed with acid-free paper and heat-resistant inks, which help you produce legible, smudge-free, and archival-safe records. Plus, the forms are compatible with popular accounting software and QuickBooks, making it easy to generate and print your 1099-NEC forms.

Easy to Use and Print

The TOPS 1099-NEC Tax Forms are designed for easy use and printing. The forms are printed 3-up on micro perforated sheets, making it easy to print and separate the forms. The IRS scannable red ink pages with copies A, C, B, 2, and C are also included, ensuring that you can produce compliant records with ease.

Important Changes for Fiscal Year 2023

The IRS has made some changes to the 1099-NEC form for the fiscal year 2023. This year, you'll no longer report cash payments for the purchase of fish for resale in NEC box 1. Instead, use the 1099-MISC box 11. Additionally, the IRS has reduced the size of the NEC to fit 3 forms per sheet, so be sure to grab new NEC envelopes designed to fit 3-up forms.

Get Your 1099-NEC Forms Today!

Don't wait until the last minute to get your 1099-NEC forms. Order the TOPS 1099-NEC Tax Forms today and ensure that you can report nonemployee compensation to the IRS and your recipients on time. The forms are due to the IRS and your recipients by January 31, so don't delay - order now!